Updated February 15, 2020.

Hello Gorgeous! Today I want to go over another method regarding budgeting and saving money for beginners. If you’re having trouble sticking to a money budget or wondering how to budget your money, then the process we are going over is for you. It also happens to one of my favorite money budget ideas. The topic for today is how to budget your money with the 50/30/20 rule. The 50/30/20 method was designed and popularized by a fantastic woman named Elizabeth Warren, United States Senator.

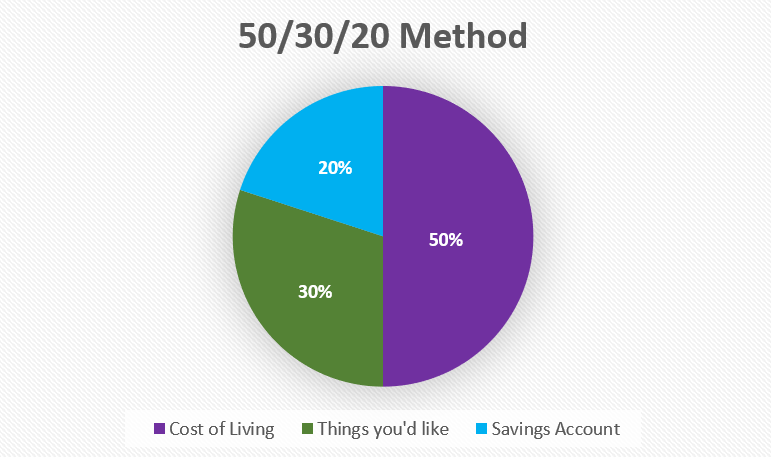

You can read more about her here, but basically, the technique states you have a whole pie, and you should cut up your budget or pie into three pieces. 50% (half) of your income should be “needs.” 30% (almost a third) should be your “wants,” and 20% (less than a quarter) should be for “savings.” This whole method is only going off of your take-home pay by the way.

Pretty simple, right? That’s what I shoot for here.

Needs

So what are “needs”? In this method are considered things that necessary for survival. Technically you could survive without a home, so let’s change the survive without to just the bare essentials. The list below is really what your essentials are. Not cable or your Kellogg brand cereal.

- Rent/Mortgage

- Groceries/Nutrition/Healthcare

- Transportation expenses

- Utilities/Toiletries

- Debt

The items above cannot be changed to be any less. For example, you can only lower your grocery budget so much. Eventually, you will hit the least amount you are going to spend, but no matter what you still need to buy food. I want to go in a little more depth to why number five is in this category.

It’s the same principle as the grocery budget really, but with a little more to it. Say the lowest amount you can pay on your credit card is $50.00, then this is a need, but now say you usually pay $100.00. The additional amount over the lowest amount you must pay should in the 20% category.

Items that go into the 50% category are things you can not get rid of no matter how much you lower the bill. If your take-home pay is $5,000.00 a month, your needs cannot exceed $2,500.00 of your budget. The 50/30/20 method is the most straightforward way on how to budget your money.

Savings

This portion of your budget, which is 20%, is the financial side of your budget. The “savings” portion is what you use to pay your credit debt or student loans with, but you are also saving some of this amount for retirement or an emergency fund. Remember the additional amount you pay towards your credit card we talked about earlier under the 50% category? It goes here. This percentage is not for saving for a trip or a car. It is for your future and grows your wealth as an individual. A vacation or a new car is a want and should go into the 30% category.

I recommend not buying a new car or planning a trip until you have mastered budgeting and you have the extra income to do so. Although you may have the money in the 30% category to save for these kinds of extra’s they belong in the “savings” portion of the budget. When you have learned how to budget your money, and you followed your budget religiously for a year or so, we will understand when you want to have a little fun to celebrate yourself!

Wants

30% of your income goes to your wants. Whoopy! For your “wants,” some people say you can go crazy here and buy whatever you want as long as it fits into your 30%. Other people lean more towards the route of this category goes toward things you don’t necessarily need, but it makes your life a hell of a lot easier.

For example cable and internet. You can live without those two things, but do we want to? Aww, see there is the word “want.” I would categorize those two things as wants for my budget, but only you can decide if they are wants or needs for you.

I use this category as things that are nice to have. When I first started on the road to becoming financially free I cut almost everything out of my budget, but my needs. I was not going to give up my rent-controlled apartment or eating.

Fast forward a few years and I have allowed things to creep back in because I can truly afford them now, but keep this thought process in mind: Can you honestly afford the new Galaxy S9 Plus or are you just excited to have the latest phone?

We are all trying to become financially independent or be the master of our budgets – These are the things you need to start thinking about when you are learning how to budget money.

Do not use this category as money to buy clothes that you don’t need or to dine out every night to meet that 30%. Use this category to develop your self. Buy educational books, take some classes at a local community college, or buy a gym membership if you do have money left.

My “wants” category has many self-development items. You are worth investing in, so invest in your self. Nip all the things you don’t need from your budget and start reallocating the money back into your self.

Let’s apply the 50/30/20 Rule for How to Budget Your Money

Example time: Money saving tips and tricks!!

Let’s use the $5,000.00 again as your take-home pay. With this amount, you can only use $2,500.00 of your income for your needs, $1,500.00 a month for wants, and $1,000.00 for savings. All of your needs that are listed above cannot exceed $2,500.00.

If they do look at refinancing your mortgage for a lower interest rate or possibly transfer your balances on your credit card. Learn here on how to reduce debt. When your lease is up moving to a more affordable apartment to help lower the cost of your needs.

Based on our example we can only use $1,500.00 a month for extras or wants. $1,500.00 goes by super quick, so pay attention to what you are spending. Track your spending for a few months and then print out debit card statements to see where you can cut costs.

Lastly, $1,000.00 is for your future savings, which isn’t too shabby. You’re going to love watching your savings account grow, and it helps you stay on course when trying to achieve financial freedom. Whenever you stress about you being so limited, you can log in to your bank account and see that number. It makes it all worth it.

The math to calculate the 50/30/20 method is super simple. You take the total amount of your income and multiply it by the percentage. So .5 is 50%, .3 is 30%, and .2 is 20%. The equation looks like this:

Total Pay X .5= Amount For Need Category,

Total Pay X .3= Amount For Want Category, and

Total Pay X .2= Amount For Savings Category.

You would change the “.” to calculate each portion of your percentages. Super easy, right? Yes, ma’am.

Xoxo,

The Finance Fairy

I wish I would have known about this rule years ago when I graduated from college, better late than never though! Great article!