Updated February 25, 2020.

I want to discuss a critical topic today: Savings and Emergency funds. 74% of Americans said they lived paycheck to paycheck in 2019. That is one paycheck away from being homeless. If you go to your bank app right now and look at your account, do you have at least $1,000.00 for an emergency? Do you have a savings account set up at all? If not, this article is going to get you there.

It is so essential for your mental health and your future to have a savings account with money actually in it. You won’t stress about taking a day off work to go to the doctor’s or worry when you get a flat tire. There are so many small events that could break the bank if you don’t have an emergency fund, so let’s begin building one.

The Savings and Emergency Funds Template

I have created a nifty little savings plan for you for free when you subscribe! If you choose to opt out of subscribing and change you mind just refresh the page and the pop-up will come back!

There are two worksheets in the workbook. The first worksheet is for the women who are just learning how to save money. They also may want to start slowly building a savings plan while they get the rest of their finances in order. The second worksheet is for the women who have started getting their finances in order. Use this when you are ready to begin investing a significant amount in their savings and emergency funds.

Emergency Fund Vs. Savings

An emergency fund is an amount you have on hand if things go south. South in the way like your alternator goes out in your car or your child has a pretty severe fever, and you want to her/him to the emergency room. These expenses are the ones you can’t foresee or plan for. A reasonable amount when saving for a safety fund is $1,000.00. The emergency fund should take priority over paying your debt down. Once you have an emergency fund with at least a $1,000.00, then start getting rid of your debt and build a savings account.

A savings account is for things you can plan for the most part. You save for a house, a new car, starting a business, or retirement for a few examples. Don’t get me wrong some time life hits you square on the head and you need to use your savings and emergency fund to stay afloat, but the goal is to have enough savings to keep you afloat during that time.

You should start building at least six months of your living expenses for a savings account. If you lost your job, you would want six months leeway to find another job and get settled in without having to stress and end up in a position you’re forced to stay in. I know six months of income sounds insane at this stage in your budgeting journey, but you will get there I promise. Financial freedom is all baby steps. Start with the emergency fund with a $1,000.00 and then start building a month of savings, and so on. Don’t try to take it on all at once. It will be overwhelming.

The Method To The Madness

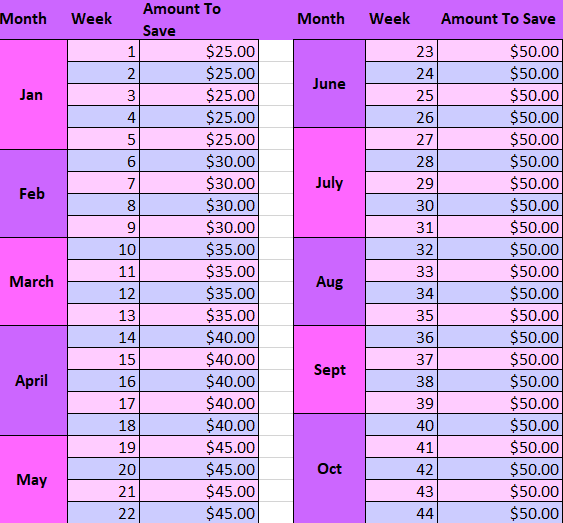

There are 52 weeks in a year, and they don’t always fall into a perfect four week per month plan. The premise behind the method of the savings and emergency funds template is to save a small amount of money every week of the year: Small amounts here and there build to nice size savings account over time. This gets you ready to increase the amount of savings each year. Every year you complete a savings plan you want to increase the amounts every week to the highest number from the previous year.

For Example, Year one the highest amount you give your savings per year is $50.00. You would start January week 1 giving $50.00 to your savings account. February week one you would give your savings account $55.00. You are following the template plan and increasing by $5.00 as the template increased $5.00 this week. You would drop $5.00 each week in November and again in December, so you have a little more wiggle room for the Holidays.

The beginner’s worksheet goes up every month $5.00 till it caps at $50.00 per week. Starting in November, the amounts go back down to account for the holidays. The Extra Savings worksheets go up to $25.00 every month and cap at $250.00 a week, but it does not drop for the holidays. This does not mean you can’t adjust certain months to have more and to have other months have less. It’s just there for you to get started and to play around. Both worksheets auto calculate how much you are saving per year based on the numbers you choose to save per week.

Amount Of Money You Should Be Saving

You should be saving 20% of your income. That’s it for this paragraph. Just kidding! That’s all you think I would give you? Of course not. If you can’t afford to do 20% of your income to start that is okay. Build up to it over time. You could also use these money making tips to save money and increase your revenue; the best part is you could be already doing some of them!

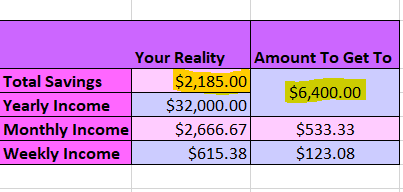

The template I created does the math for you. All you have to do is enter your annual salary amount, and the monthly, weekly, and amount you should be saving are all auto calculated. Woohoo for easy money budgeting! You type one number, and you get five numbers back. That is an excellent return on investment, I must say. The goal is to eventually get the “Total Savings” cell to match the “Amount To getting To” cell. When that happens, you are saving 20% of your income. Below is an example to show you what I mean.

Savings and Emergency Funds Summary

Let’s recap the benefits to having an emergency fund.

The most understated benefit is the peace of mind that comes from knowing you have enough money “in case sh!t” happens.

Second, is the confidence you’ll be building knowing you’re practicing the discipline of making sure you’re financially secure.

Which leads directly into the third benefit which comes from turning a practice into a habit: as you practice on your discipline, the monthly goals and routine will seem easier and easier to reach.

Be sure to check out the rest of the blog for more. And make sure to share!

If you have any comments, questions or concerns head over here to email me.

Xoxo,

The Finance Fairy

Wow! I’ve been looking for something that helps me break down the Savings Process so that I can use that as one of my SMART goals for 2019! 20% of income should be saved… thanks for showing us the stats. I better get to work!

I’m going to keep Bloom planners in mind, thanks for the tip!

Couldn’t agree more with this. It’s really important to know the distinction between an emergency fund and a savings account. I built up my savings account over the past 3 years so I could quit my job and travel for a while and it’s really reassuring to know I also have my emergency fund as a different account.

That’s so amazing that you were able to quit your day job and just travel! That is my current goal and can’t wait to get there.

Those seem like some really simple tips to saving money. I always seem to struggle but I’ll give this weekly thing a go! Thank you!

Love how simple and straightforward this is.